Income

My Bill Tracker supports a way for you to track your income so that the information can be used in various areas of the applicaiton.

- At the top of the Payment Log screen you will see the Available Funds label which is the amount of in income minus payments you've made to bills.

- In the reports you will see a tab for Data Points, there you will see information about how much you'll need to earn a year to be able to make your payments every month.

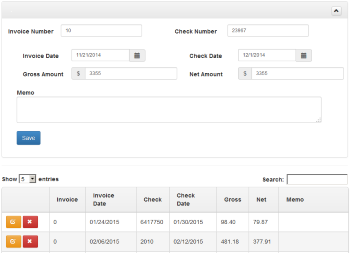

To enter your check each time you get paid just simply complete the form fields and click Record Income.

- Invoice Number - If you are a contractor or business you can enter the Invoice number but if you are an employee for a company you can just enter a 0 in this field.

- Check Number - The check number should be printed on the check you receive no matter if it is a personal check or a business check.

- Invoice Date - Enter the date that you submitted your invoice or if you are an employee simply enter the date the pay period ended.

- Check Date - Enter the date that you received your paycheck.

- Gross Amount - This is the amount you earned before taxes. This should also be present on your check. If it is a personal check it would be the entire dollar amount.

- Net Amount - This is the amount that you take home after taxes. If this is a business check the amount should be printed. If this is not then it is your responsibility to determine what your net amount should be.

- Memo - Feel free to enter a memo or note regarding the details of your paycheck. You're free to enter anything you like.

Once you are finished completing the form click the Record Income button. You should see a new row created in the table indicating that it was sucessful.